OUR PROGRESS

Harambeans are empowering a new generation of African innovators and building an entrepreneurial ecosystem that transforms bold ideas into scalable solutions across the continent. What began in 2008 as the “Dream on a Piece of Paper’’ among a group of young Africans on the slopes of Mount Washington – guided by the Harambe Declaration – has, over the past eighteen years, grown into a vibrant, pan-African Alliance of 402 members. United in diversity, Harambeans are ambitious, impactful, and a source of inspiration, driving meaningful progress across sectors. These visionary leaders are scaling ventures that shape not only Africa’s future, but the future of the world. With each successful round of investment, they reinvest in their communities, fueling growth and expanding their impact. To invest in Harambeans is to invest in the promise and potential of Africa itself.

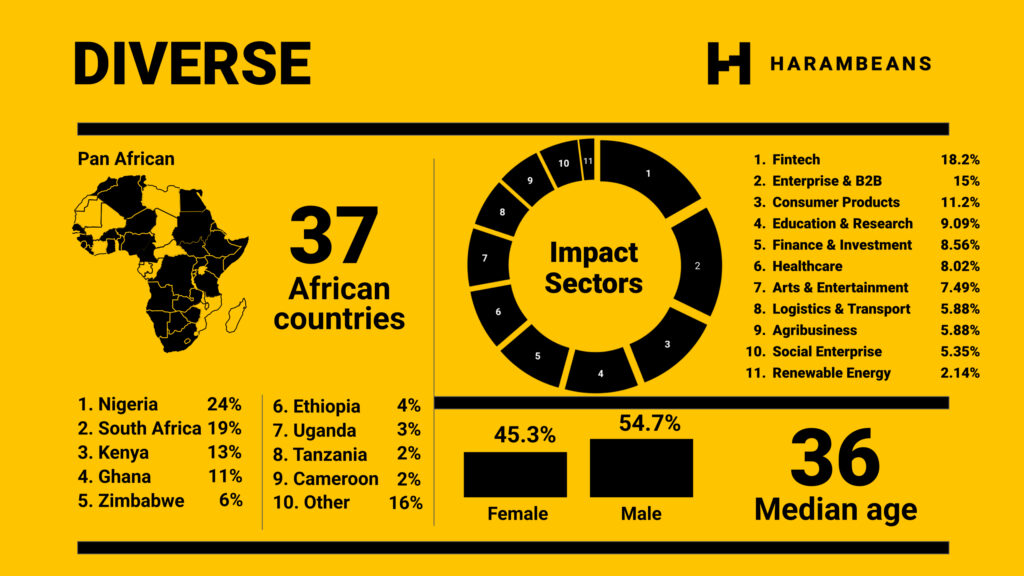

DIVERSE

Harambeans share a common set of values that spans cultures and countries. Our culture is what binds our entrepreneurs, investors, and partners together. The proof is in our numbers — 402 Harambeans representing 37 African countries, dozens of languages spoken, and an almost even split between male and female members.

With a background in investment banking, asset management, and capital advisory, Julia Price H’24 has long sought to merge philanthropy with commercial investing. She co-founded Linea Capital to connect impactful businesses with large volumes of capital through smart, founder-friendly models. Linea’s revenue-based finance (RBF) approach offers funding without equity dilution, focusing on high-impact, growing businesses that drive gender equity and job creation. The model supports founders in scaling revenues locally and internationally while helping retain ownership and increasing capital flows across a finance-starved continent. Since launch, Linea has completed 18 RBF deals with six successful exits.

Ebby Gatamu H’24, co-founder of Cladfy, is also addressing a major capital gap – sub-Saharan Africa’s $300 billion SME financing shortfall. Despite the informal sector accounting for 80% of jobs and 55% of GDP, it receives just 20% of formal credit. Cladfy empowers microlenders – who are well-versed in the micro and small enterprise segment – with the software and financing tools they need to scale their impact. To date, Cladfy has enabled over 40,000 small businesses to access more than $3 million in working capital and supports dozens of lending partners. Gatamu envisions Cladfy becoming “Africa’s Shopify for lenders,” transforming access to finance for the continent’s most underserved entrepreneurs.

Initiatives like these are amplifying impact, broadening representation, and shaping a future for Africa that is both inclusive and sustainable.

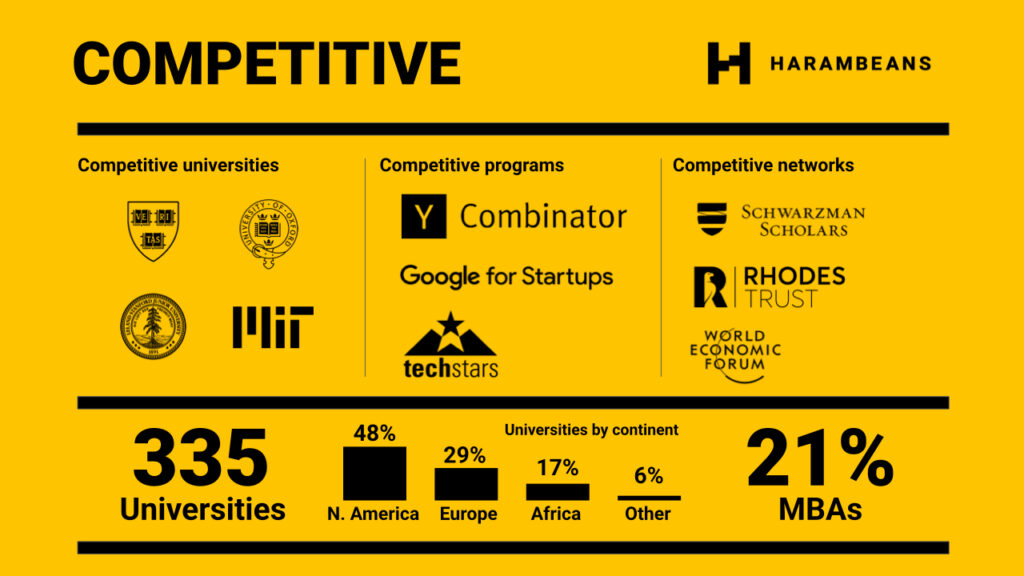

COMPETITIVE

Harambeans are selected from a highly competitive pool of applicants representing over 335 top universities worldwide. Our Alliance includes graduates from globally renowned institutions such as Harvard, MIT, Stanford, Oxford, Cape Town, Yale, and others known for cultivating exceptional leaders and visionary entrepreneurs. The achievements of Harambeans have been widely recognized, earning hundreds of prestigious accolades, including honors from the World Economic Forum, Y Combinator, and the Rhodes Trust, among many others.

Feven Tsehaye H’25 has a Master’s in Public Administration from Tsinghua University in Beijing, China. She was a consultant with the Bill & Melinda Gates Foundation in China and a Fellow in their Ethiopian office. Drawing on her background in social impact investment, she had a mission: to unlock the power of indigenous biodiversity while creating meaningful economic opportunities for women farmers. She launched Chakka Origins as Ethiopia’s first vertically integrated, specialty natural ingredients company focused on wellness, personal care, and food. Chakka Origins is a growing enterprise with 14 employees and a network of over 2,000 trained women farmers across Ethiopia. The company exports to high-growth markets in the US and UK, where natural product demand is rising by 7%-9% annually.

Moses Mukundi H’25 is the founder of Eden Care, a company providing comprehensive health insurance coverage for the 100 million employees employed by the formal and informal sectors in Africa. Eden Care has curated a network of more than 650 trusted healthcare professionals and wellness experts and works with employer groups as well as individual members and their dependents. Tom Bloomingfield, a partner at Y Combinator, was both an advisor and investor who helped Mukundi with his expansion strategy. With more than 10 000 lives covered, Mukundi scaled the business to achieve gross premiums of $2.4 million in under 8 months of full operation.

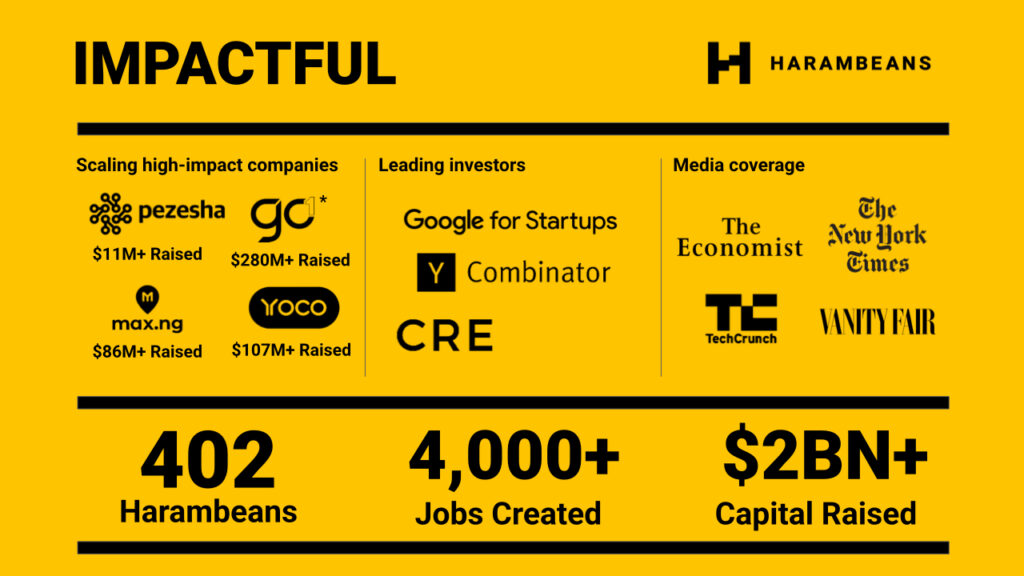

IMPACTFUL

Recognized by institutions such as the African Union, The Economist, and the Vatican, Harambeans embody the entrepreneurial drive and determination of a new generation of African leaders. Over the past decade, they have launched a wave of tech-enabled ventures, including Andela, Flutterwave, and Yoco, that have collectively raised over $2 billion from investors like Google for Startups, Y Combinator, CRE, and 500 Startups, while generating more than 4,000 jobs across the continent.

Wyclife Omondi H’25 is co-founder of BuuPass, a company transforming travel across East Africa. Partnering with over 50 transport operators in Kenya, Uganda, and South Africa, BuuPass now covers 800+ routes with 1,250 active buses. The platform has raised $5 million, served 2.5 million customers, sold 16 million tickets, and processed over $100 million in gross merchandise volume. It serves nearly 293,000 bus passengers, 462,000 train users, and 1,300 flight customers, with parcel delivery contributing 11% of its revenue.

Leana de Beer H’25 founded WaFunda to promote “education for all” through an Income Share Agreement (ISA) model offering up-front tuition funding in exchange for a fixed slice of graduates’ future pay checks. Early pilots at private institutions funded 750 students with R45 million, achieving a 95% graduation and 90% repayment rate. She now plans to launch ISA funding across South Africa’s top five public universities, targeting over 35,000 students and raising R157 million—paving the way toward a R500 million fund to reshape national student financing.